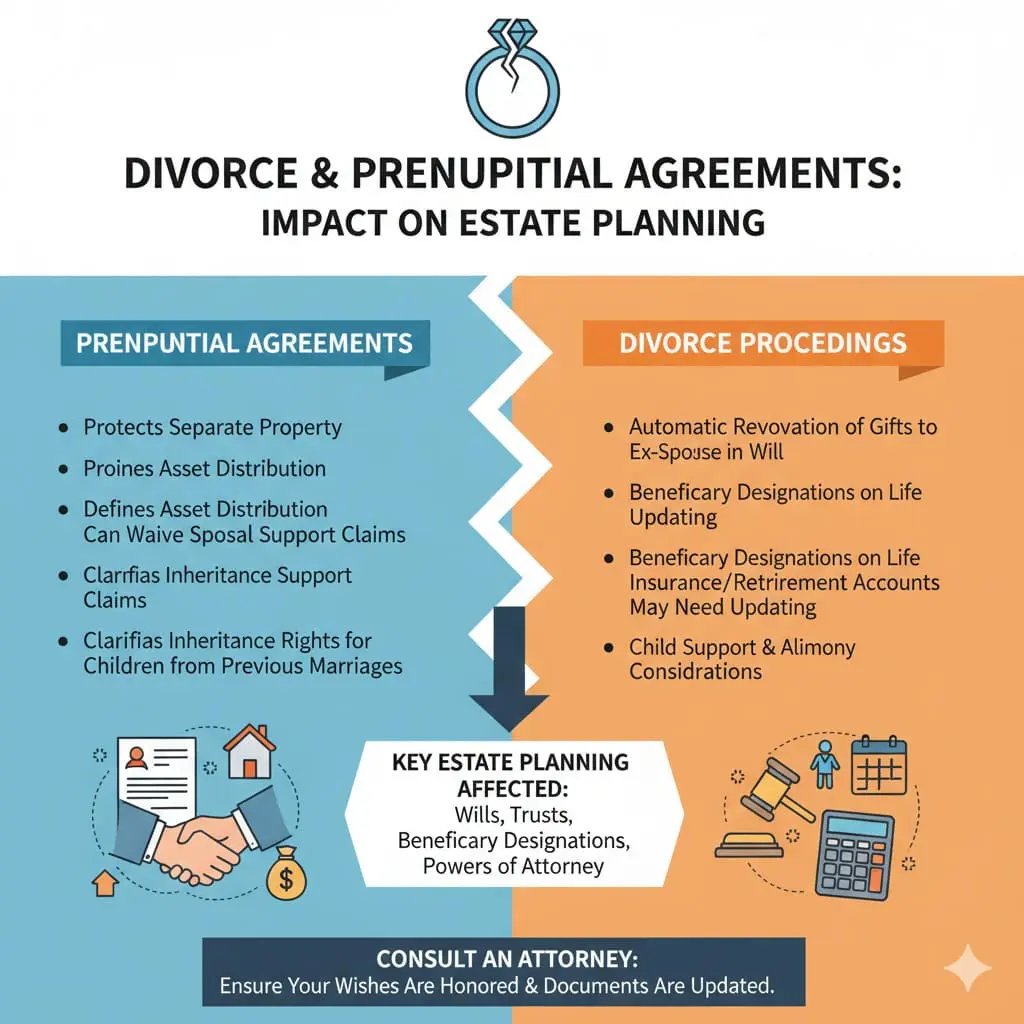

Estate planning and family law often operate in parallel, but they intersect more frequently than people realize. Divorce, remarriage, prenuptial agreements, and ongoing support obligations can quietly reshape an estate plan in ways that are easy to overlook and costly to ignore.

Many people assume their estate plan automatically “adjusts” after a divorce or marriage. In reality, the law only goes so far. Without intentional updates, outdated documents can survive major life changes and produce results no one intended.

Divorce Does Not Automatically Rewrite Your Estate Plan

Divorce alters legal relationships, but it does not comprehensively revise your estate planning documents. In many states, divorce revokes certain provisions in favor of a former spouse, such as executor appointments or beneficiary designations in a will. That said, the scope of automatic revocation varies by state and does not extend to every document.

Trusts, powers of attorney, beneficiary designations, and contractual obligations often remain intact unless they are formally updated. People are frequently surprised to learn that an ex-spouse may still control assets, receive distributions, or act in a fiduciary role simply because documents were never revised.

The safest approach is to treat divorce as a mandatory estate planning reset, not a partial one.

Beneficiary Designations Are a Common Problem Area

Retirement accounts, life insurance policies, and payable-on-death accounts pass by beneficiary designation, not by will. Courts generally honor the designation on file, even if it names a former spouse.

Divorce decrees sometimes require updates, but financial institutions rely on their own records. If those records are not changed, assets may flow to an unintended recipient. Cleaning up beneficiary designations after divorce is one of the simplest steps to avoid litigation later, yet it is often delayed or forgotten.

Trusts Created During Marriage May Need Structural Changes

Many married couples create joint trusts or mirror estate plans. After divorce, those structures often no longer make sense.

A trust designed to benefit a spouse during life may conflict with new priorities, blended families, or support obligations. Some trusts cannot be easily changed without cooperation from both parties, depending on how they were drafted and funded.

In these situations, careful review matters. Sometimes the solution involves amending terms. Other times, it requires decanting assets or creating entirely new structures. Ignoring the issue usually makes it harder to fix later.

Prenuptial Agreements and Estate Planning Must Work Together

Prenuptial agreements are contracts. They control property rights during marriage and at death. When estate planning documents contradict a prenup, courts generally enforce the contract.

This creates a common problem: someone signs a prenup early in life, later creates a will or trust that ignores it, and assumes the newer document controls. It often does not.

Estate plans should explicitly reference prenuptial agreements and align with their terms. This coordination avoids confusion and reduces the likelihood of disputes between surviving spouses and children from prior relationships.

Alimony and Support Obligations Can Affect the Estate

Support obligations do not always end at death. Depending on the divorce agreement or court order, alimony may survive and become a claim against the estate.

Life insurance is often used to secure ongoing support obligations, but only if policies are properly structured and maintained. If coverage lapses or beneficiary designations change without regard to the support agreement, the estate may be exposed.

Estate planning should account for these obligations upfront, especially when significant support remains outstanding.

Guardianship and Children From Prior Relationships

Divorce introduces additional complexity when children are involved, particularly in blended families.

A will allows a parent to nominate guardians, but that nomination does not override the rights of a surviving parent. Still, it matters. Courts consider the will as evidence of intent, especially if circumstances change later.

Trust planning becomes even more important in these cases. Leaving assets outright to a minor or through a former spouse often creates tension and risk. Trusts can provide structure, oversight, and clarity without placing unnecessary control in the wrong hands.

Remarriage Requires a Fresh Look at the Entire Plan

Remarriage is another moment when estate plans commonly fail to keep up. New spouses gain legal rights, sometimes unintentionally disrupting plans made for children from a prior relationship.

Elective share laws, community property considerations in some states, and spousal support rights can override carefully written documents if they are not addressed explicitly.

Blended families benefit from proactive planning that balances spousal protection with clear boundaries. Trusts, waivers, and coordinated beneficiary designations help avoid conflict between surviving spouses and adult children.

Why Timing Matters More Than People Expect

Many estate planning mistakes happen during transitions. Documents created in the middle of a divorce or shortly after remarriage are more likely to be challenged if capacity, pressure, or confusion is alleged.

Taking time to plan deliberately, rather than reactively, improves the durability of the documents. Courts pay close attention to timing, consistency, and clarity when disputes arise.

A Coordinated Approach Works Best

Estate planning does not exist in isolation. Divorce agreements, prenuptial contracts, and support orders all shape how assets move and who controls them.

The most effective plans acknowledge these realities. They use clear language, consistent structures, and realistic assumptions about family dynamics. When estate planning and family law work together, outcomes are far more predictable.

Major life changes deserve more than minor document edits. They require a thoughtful review of how legal obligations, relationships, and assets interact.

Addressing these issues early reduces uncertainty, protects loved ones, and prevents disputes that often surface years later when they are hardest to resolve.